Agricultural Checking

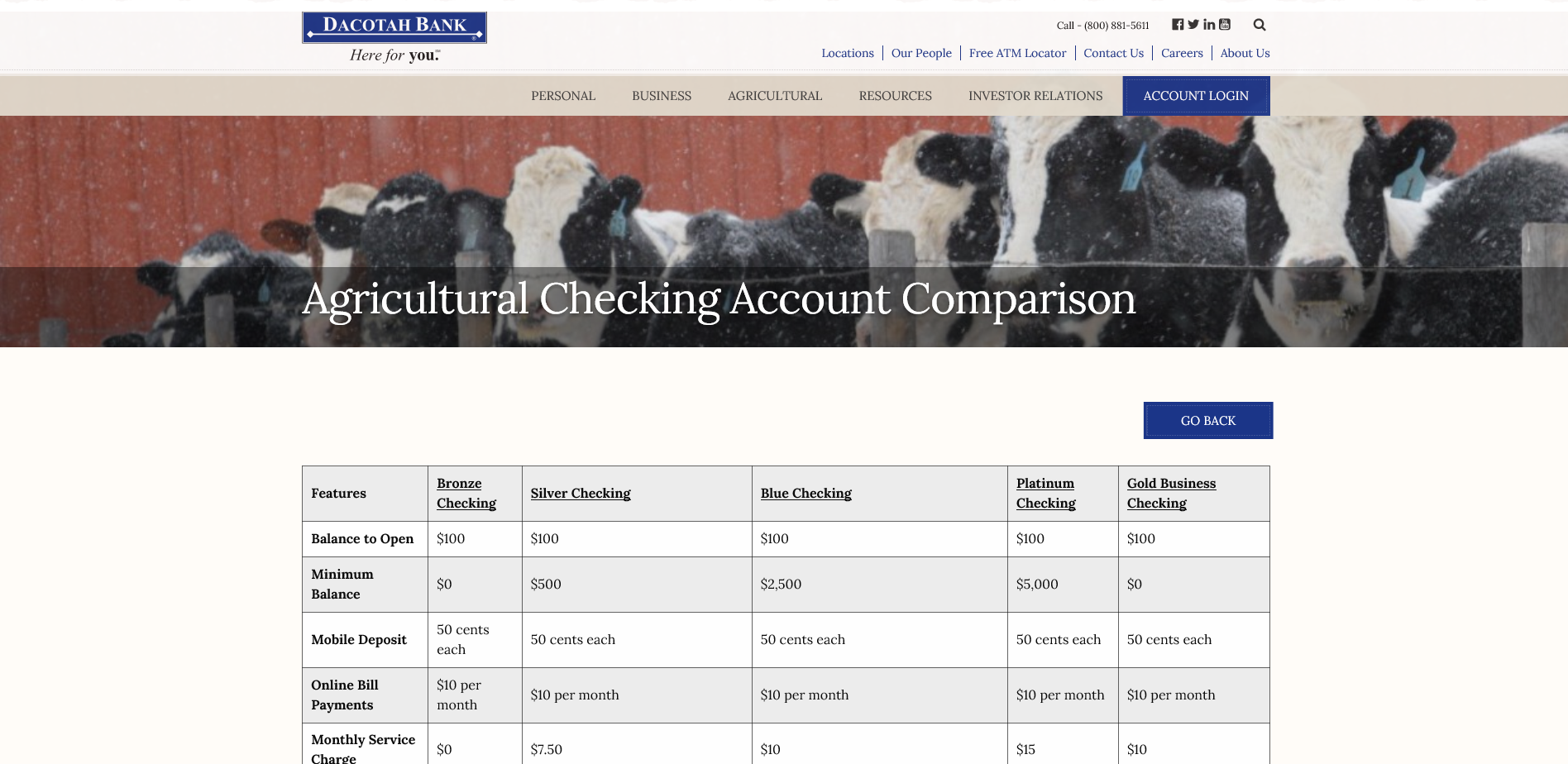

- Bronze Checking

If your business or organization keeps a low balance and you write or deposit less than 50 checks per month, Bronze Checking may be for you. Contact Us.

- $100 minimum deposit to open

- No minimum balance to maintain

- No monthly service charge

- Free Visa business debit card

- Free online business banking

- Free eStatements

- Make unlimited online Bill Payments for just $10 per month

- Free mobile deposits from your smart phone or tablet

- Order low-cost Business Checks online

- Enjoy $250,000 FDIC protection – visit www.fdic.gov

- When you have more than 50 checks written or deposited in a month, a charge of 20 cents for each item in excess will appear on your bank statement

- Silver Checking

If your business or organization typically has a balance of $500 or more and you write or deposit less than 100 checks per month, Silver Checking may be for you. Contact Us.

- $100 minimum deposit to open

- $500 minimum balance requirement

- A monthly service charge of $7.50 can be avoided when you maintain the minimum balance and use your business debit card at least 10 times per month

- Free Visa business debit card

- Free online business banking

- Free eStatements

- Make unlimited online Bill Payments for just $10 per month

- Free mobile deposits from your smart phone or tablet

- Order low-cost Business Checks online

- Enjoy $250,000 FDIC protection – visit www.fdic.gov

- When you have more than 100 checks written or deposited in a month, a charge of 20 cents for each item in excess will appear on your bank statement

- Blue Checking

If your business or organization typically has a balance of $2,500 or more and you write or deposit less than 200 checks per month, Blue Checking may be for you. Contact Us.

- $100 minimum deposit to open

- $2,500 minimum balance requirement

- A monthly service charge of $10 can be avoided when you maintain the minimum balance or use Merchant Solutions or Online Deposit Services from LibertyPrime Bank

- Free Visa business debit card

- Free online business banking

- Free eStatements

- Make unlimited online Bill Payments for just $10 per month

- Free mobile deposits from your smart phone or tablet

- Order low-cost Business Checks online

- Enjoy $250,000 FDIC protection – visit www.fdic.gov

- When you have more than 200 checks written or deposited in a month, a charge of 20 cents for each item in excess will appear on your bank statement

- Platinum Checking

If your sole proprietorship business or non-profit organization keeps a balance of $5,000 or more and you write or deposit less than 200 checks per month, Platinum Checking may be for you. Contact Us.

- $100 minimum deposit to open

- $5,000 minimum balance requirement

- A monthly service charge of $15 can be avoided when you maintain the minimum balance

- Earn competitive interest every day your balance is above $5,000

- Free Visa business debit card

- Free online business banking

- Free eStatements

- Make unlimited online Bill Payments for just $10 per month

- Free mobile deposits from your smart phone or tablet

- Order low-cost Business Checks online

- Enjoy $250,000 FDIC protection – visit www.fdic.gov

- When you have more than 200 checks written or deposited in a month, a charge of 20 cents for each item in excess will appear on your bank statement

- Gold Business Checking

If your business or organization has a high volume of checks written and checks deposited each month, Gold Business Checking may be for you. Account balances and activity are analyzed every month to ensure your service charges are the lowest they can be – an important consideration for larger businesses. Contact Us.

- $100 minimum deposit to open

- No minimum balance requirement

- A monthly service charge of $10 can be avoided by the earnings credit as it may reduce or offset the charge

- Free Visa business debit card

- Free online business banking

- Free eStatements

- Make unlimited online Bill Payments for just $10 per month

- Free mobile deposits from your smart phone or tablet

- A low 15 cents per check processing charge

- A low 8 cent charge per item deposited

- Order low-cost Business Checks online

- Enjoy $250,000 FDIC protection – visit www.fdic.gov

- Note: An asset protection charge is applied at a rate of 11 cents per $1,000 on deposit

- Online Deposit

Improve your cash flow and employee efficiencies by making deposits online! LibertyPrime Bank’s Online Deposit service enables you to capture customer check images and submit deposits electronically.

To learn more, contact your nearest Business Banker or call (800) 881-5611 Extension 5395.

- Make multiple deposits a day

- Eliminate trips to the bank in the rain, heat, or snow

- Research checks and deposits easily and quickly

- Reduce the risk of robbery or lost deposits

- Reduce the risk of fraud

- Business Overdraft Protection

Never be embarrassed by the delay and expense of an overdraft again with Business Overdraft Protection – a convenient line of credit that automatically keeps your business checking account funded up to a pre-approved limit. Apply Now!

- One low annual fee equal to ten cents a day

- Your Business Banker will be happy to discuss fees, current rates, and payment schedule during your application process

- Direct Deposit

Save time and money and eliminate worry by having your paycheck, benefits payments, stock dividends, and other recurring deposits made electronically to your LibertyPrime Bank checking or money market account. To get started please Contact Us.

- Health Savings Accounts

Save money on health insurance premiums and take control with a Health Savings Account. Your Health Savings checking account includes a free Visa CheckCard and lets you pay for qualified medical expenses easily – and you’ll help save the environment. Contact Us!

- $100 minimum deposit to open

- Earn tiered interest on your balance each day

- Free Visa CheckCard

- Free online personal banking

- Free mobile banking app

- Free eStatements

- Get Fraud-Defender ID Theft restoration for just $2.95 per month

- Make mobile deposits from your smart phone or tablet for just 50 cents each

- Make 12 free online Bill Payments per month

- Free 24/7 phone banking

- Enjoy $250,000 FDIC protection – visit www.fdic.gov